Portfolio Liquidity

05 Dec 2018 . Category:

Portfolio

PortfolioReview

A rather dull topic, though worth a note so as I can document what the hell I was playing at w.r.t. currency holdings during the Brexit transition.

As I have a large percentage of my Portfolio in Cash, I’ve been watching the Brexit

situation with reluctant interest. The near term direction of GBP appears to be a binary

bet on the outcome of the next weeks vote.

Given this, I started moving cash out of pounds sterling and into USD, which many feel

could outperform due to a dollar shortage. I had hoped for more of a dip to move more across,

but have managed to re-allocate a large percentage my cash holdings.

In the unlikely event of a successful leave vote, I can see sterling increasing against other currencies. I think more likely there’ll be indecision and it will drop further. Regardless, I’m expecting the long term down trend in Sterling and so the trade represents good risk/reward.

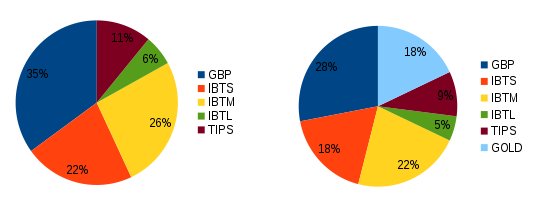

As of today, here’s how things stand in the cash part of my portfolio:

Short Duration US Treasuries (IBTM) - These have short duration (0-3yr) and so are a good

proxy for USD. Not sensitive to interest rates. A safe store of value.

Medium / Long Duration US Treasuries (IBTM / IBTL) - USD exposure but introduces interest rate risk,

with the latter being particularly sensitive. If I’m wrong and GBP/USD moves against me, I’ve also the possibility

of making any losses back due to the bond yields falling pushing the price of the bonds up. As market weakness in

2019 is my baseline scenario, this gives me 2 bites of the same cherry - which makes it a good trade. Obviously,

strong GBP and strong stock market would be a disaster…

Short Duration TIPS (TP05) - Inflation protected US bonds with 0-5yr duration. I’ve added these as

many of my multi asset funds hold similar and they seem a safe place to hide.

Gold - It’s shiny. I wasn’t sure to include this, hence one chart with/without above.

So, a bit of everything - choosing not to be exactly right or exactly wrong, but somewhere in between, allowing me to live to fight another day. I’m retaining a sterling chunk which will allow me to take advantage of any downturn in the market.

Things are made more difficult in that my accounting is in Euros, so may have to pay gains that otherwise wouldn’t. There’s no way round this.

Summary: It’s a difficult environment to choose where to hold liquidity and I’m hedging my bets. I managed to largely circumvent the earlier devaluation, so hoping for similar this time round. I did tell you it was dull.