Secular Trend: Commodity Cycle

28 Nov 2019 . Category:

Investment

Investment

Investment Thesis

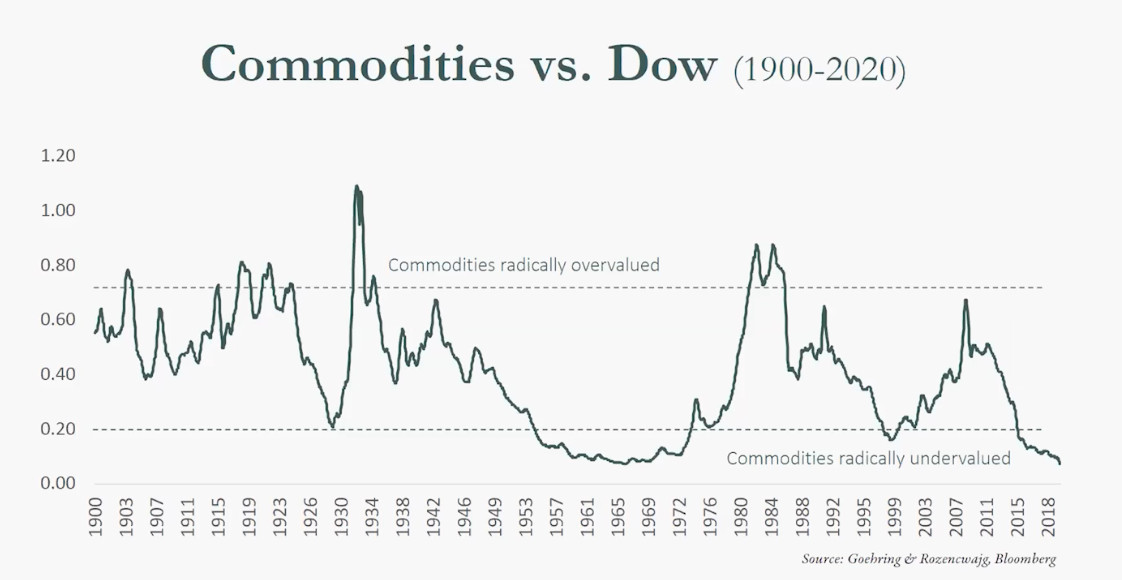

Since the financial crisis of 2008 and the resulting QE, financial assets have significantly outperformed real assets. The following chart shows just how extreme this outperformance is:

Interest rates now around their limits at the zero bound, new policies are being considered (MMT) which are said to be much more inflationary.

The last time we were in an inflationary environment was 1970s, equities were shunned and commodities performed very well. My thesis is that in the near future, the bear market in real assets will end and they will once again outperform.

Considering the ~10 year underperformance of commodities in the above chart, revision to the mean suggests that they could be a good place to be.

In the event of a recession, my expectation is for the value of real assets to drop as well as equities. If they were to fall, then they’re falling from a low base and I’d expect a quick recovery.

Method

Strictly speaking, my large allocation to uranium as part of my Electricity Demand theme should be considered a commodity allocation - but I’m choosing to put that in a different silo as has it’s own driving factors.

This theme is more general and I intend to play it by investing in royalty companies focused on base metals, rather than commodity funds. As Horizon Kinetics explain:

While mining companies have appreciated during brief bouts of inflation, they have done poorly during extended periods of inflation. This is because they are asset intensive businesses, both as to physical capital and human capital. Over time, inflation acts upon the cost of replacing equipment, of purchasing and developing new reserves, and of retaining and compensating employees. This erodes both profit margins and the stock valuations.

Russel Clark gave an example of this when he who noted that BHP lost 90% of its value in the 1970s during an inflation boom. Horizon Kinetics go on to explain that there is a limited universe of business models that are asset-light, rather than asset intensive, and which derive their revenues from assets that tend to be inflation vectors. One example is a royalty company.

Royalty Companies

“The best business is a royalty on the growth of others - requiring little capital itself” Warren Buffett

Royalty companies can be considered as a finance business rather than a mining business, providing capital in exchange for revenues. Royalty companies don’t require capital equipment or property; neither do they have any operations per se, just administrative staff. Therefore, they benefit fully from any increase in the price and volume of the underlying commodity in which they have a royalty interest.

Advantages include:

- Very high profit margins (profitable even if commodity price declines)

- Low Risk(I): Mining companies must pay royalties prior to all other deductions.

- Low Risk(II): Falling commodity prices squeeze miners costs. Royalties unaffected.

- Low Risk(III): Unaffected by unexpected costs (cost overruns etc).

- Better Inflation Hedge: Mining cost increases => Less profits for Miners. Royalties unaffected.

- Upside not priced in (Mine life extensions, Commodity price increases, New discoveries)

- Trading at low multiples to NAV when compared with precious metal peers.

One obvious question: if royalties are so profitable, why do mining companies sell them? The reason is that after selling a royalty, the mining companies don’t start to pay back until the mine is producing, which can be several years. If they instead chose debt, they would have years of interest payments to make prior to production

As well as capturing the commodity upside, it is anticipated that the discounts to NAV should narrow as the companies increase in size as borrowing becomes cheaper.

Links

Simon White

GoRozen.

Good Vid on Royalty Rationale

therationalcloning RoyaltyWriteup