Secular Trend: Currency Debasement

08 Nov 2019 . Category:

Investment

Investment

Investment Thesis

“Paper money will always return to its intrinsic value. Zero.”

In a fiat based monetary system, the value of money is slowly eroded over time which amounts to a significant hidden tax on savings. Governments can borrow money via the bond market and pay back with devalued money in the future; the alternative of raising taxes is not popular with their electorate. A gold sovereign (the original pound coin) had a value that remained static for 100s of years, until the advent of fiat money - it’s now worth ~275x what it originally was.

In contrast, gold is an extremely stable store of value. They say that in Roman times, an ounce of gold would buy a toga and a fine meal and that today that same ounce would buy a suit and a similar meal.

Many governments like to describe gold as merely a pet rock, even though their central banks are rushing repatriate their holdings and increase them as they likely know what is in store. It’s in their interests to talk it down, yet occasionally the truth slips out. Here’s a recent quote from the Dutch central bank :

Gold is the perfect piggy bank, it’s the anchor of trust for the financial system.

If the system collapses, the gold stock can serve as a basis to build it up again.

Gold can’t be printed, it’s growth closely matches that of worldwide population growth. Gold is universally recognised as having great value (game theory ‘Schelling point’ ). It has all the properties of money as described by Aristotle.

With the dramatic escalation of money printing in recent years and bonds no longer giving any return, it makes sense to hold a sizeable percentage of a portfolio in precious metals.

Given golds few other uses, when the time comes it can be instantly revalued to any dollar value without knock-on effects, then used to back currencies and wipe out sovereign debt.

Method

For the reasons expanded upon below, I intend to use direct investment into physical silver as my main exposure to this theme. I may additionally hold a smaller amount of mining companies.

Silver

Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants & debt is the money of slaves

Silver is significantly more volatile than gold, but the potential returns are far greater. This is the reason that I have opted to hold it in my growth portfolio - as a levered play on currency debasement.

Compared to gold, silver is a tiny market. The same amount of money entering the silver market would drive it far higher. Alternatively, the market could be contained (manipulated) with a far smaller amount of money.

Silver is both a precious and an industrial metal. It is a by-product of other industrial metal mining and so in a crisis I’d expect its supply to decrease and support the price.

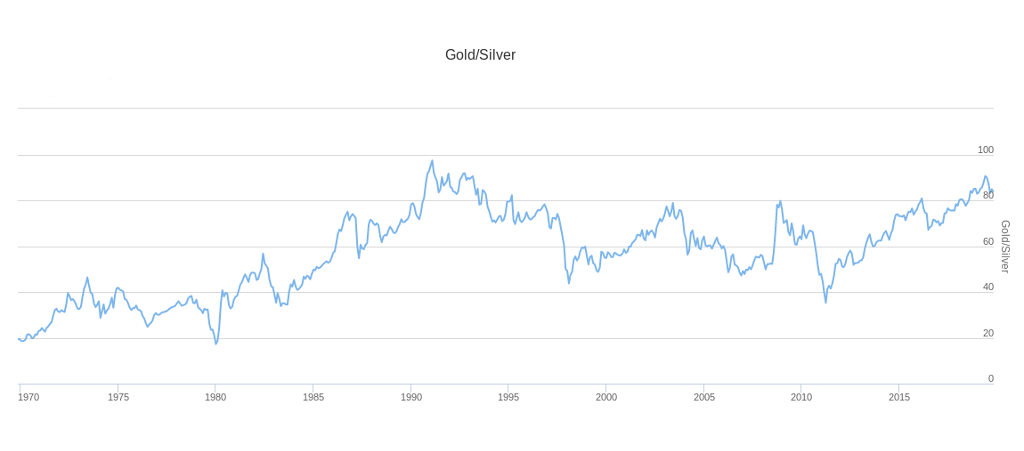

Gold / Silver Ratio

One key aspect of silver investment is the ratio of gold to silver, currently around 85. In times of crisis this could decrease to around 20 or so, which gives the leverage to supercharge the returns.

The natural ratio of gold to silver is said to be 17.5:1 which is close to the monetary ratio used in the 19th century of 16:1. In the 1970’s the Hunt brothers expected the ratio to go to 5 - so 85 seems a good entry point.

Also consider that, as an industrial metal, Silver is consumed (65%) whereas all the gold that has ever been mined still sits in Vault. This should put a steady downward pressure on the ratio.

Miners

Precious metal mining stocks are another alternative ‘levered’ play on currency debasement, with explosive returns.

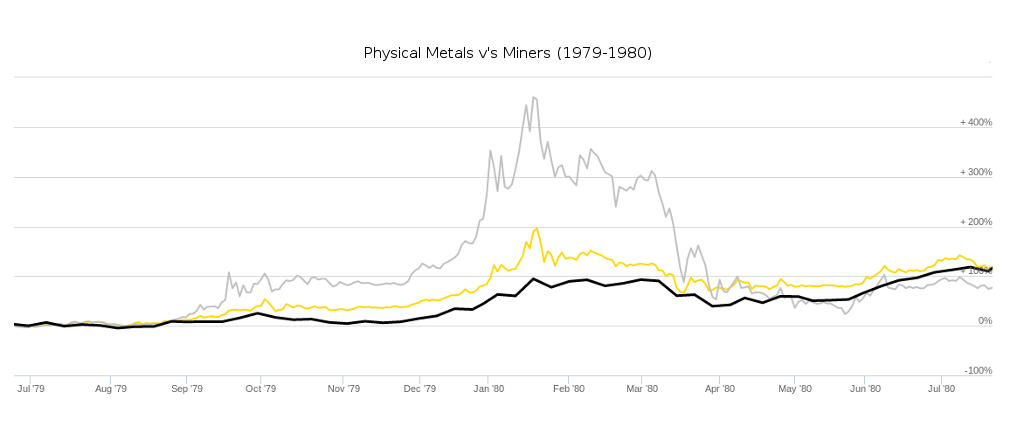

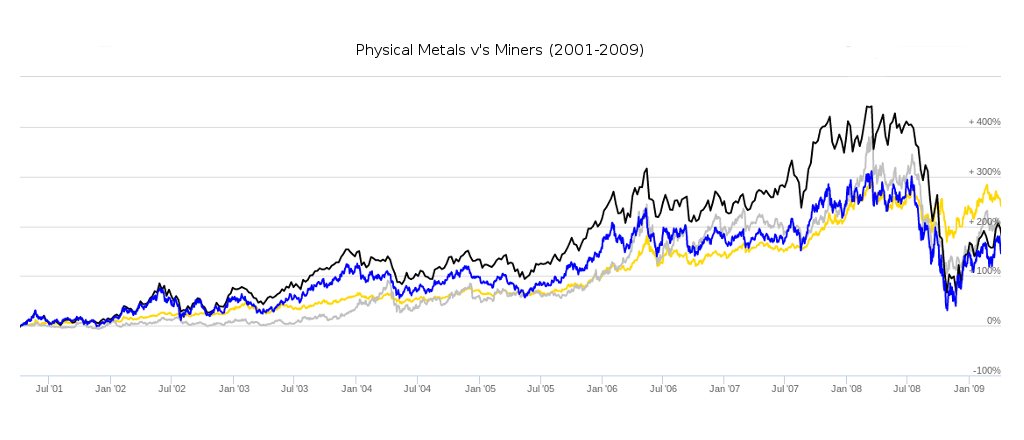

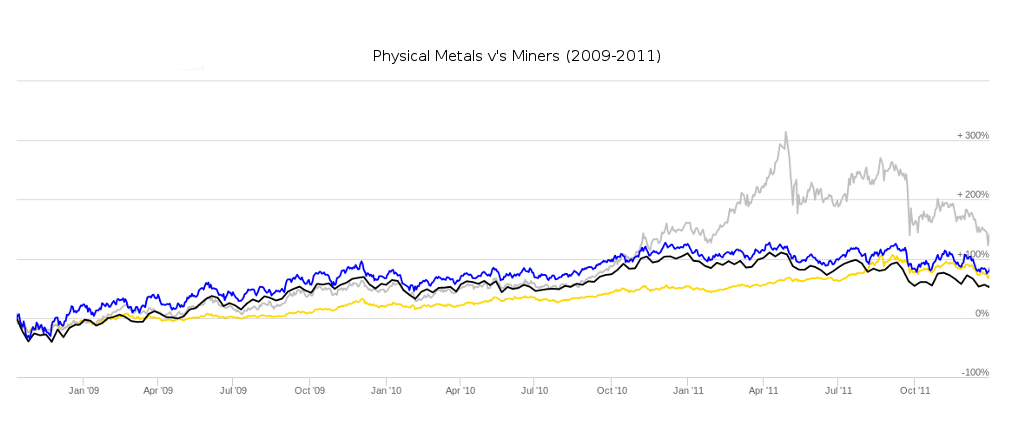

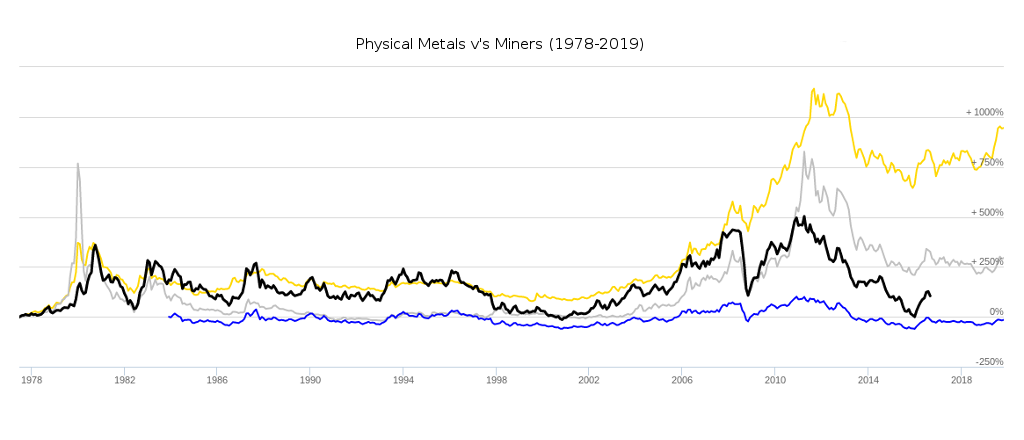

I had intended to invest in ‘Jr’ miners, though the following charts have caused me to reconsider this as long term returns are very poor, as can be seen in the chart below. Investment in silver looks to be as good during bull phases and much better over longer time frames, with no company risk.

In this Real Vision interview, Dan Tapiero and Thomas Kaplin raised the possibility (expectation even) that when gold is much higher, governments in many countries may expropriate mines. They emphasised need to stick to safer jurisdictions. My take from this would be to not invest in ETFs which will include all jurisdictions, and stick to individual names in North America.

In the charts below the black line is the Barrons Gold Mining Index and the blue the Philadelphia Gold and Silver Index:

The following charts show performance during each of the past 3 bull runs: