Importance of Non-Correlation

08 Feb 2018 . Category:

Investment

AssetAllocation

I intend to structure my investments using a rough asset allocation model, aware of asset allocations such as the Harry Brown portfolio can give results similar to 100% equity, but with significantly less volatility.

“In investing, diversification is the only free lunch”

Harry Markowitz

Interesting chart time:

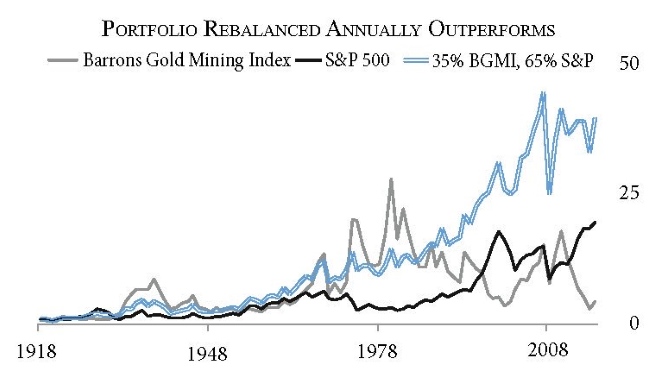

Between 1916-2016, the return on S&P was 18.4 times, compared to 37.9 times for the S&P/BGMI rebalanced portfolio.

It may seem quite unintuitive, but the chart is showing that adding a vastly underperforming asset can significantly increase the total return of a re-balanced portfolio compared to 100% equity. The key is that the assets are uncorrelated, that one is zigging while the other zagging - this is more important than the return of the asset.

Mark Spiznagel explains this as follows:

As long as the underperforming component adds value during market weakness, the rebalanced portfolio experiences reduced drawdowns and, therefore, compounds at a higher rate over time. Most sensible investors look only for opportunities with the highest returns, but long term returns greatly depend on having uncorrelated components, even if some of those components have a low return or even no overall return

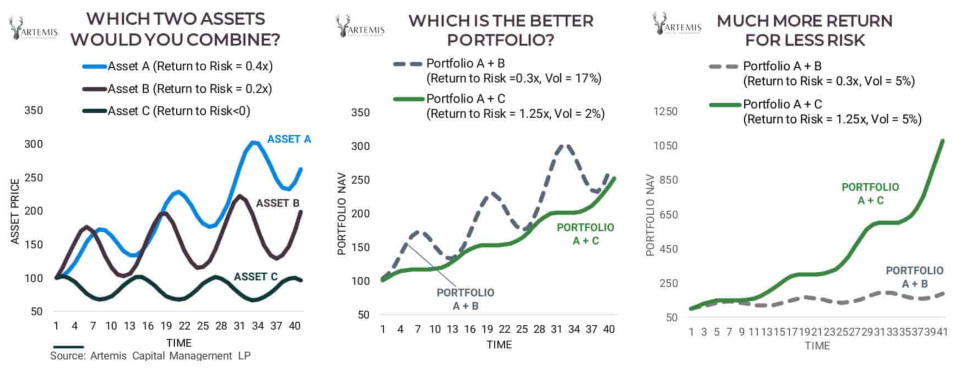

In their “The Allegory of the Hawk and the Serpent” report, Artemis Capital detail how to invest for 100 years. To summarise:

“Anti-correlation is worth more than excess return”

Liked that. The secret of investment in less than 8 words. It’s worth reading that note in it’s entirety.

Bonus chart time :

This site talks about David Swenson the former CIO of Yale Endowment who noted that there are 3 sources of returns: asset allocation, market timing, and security selection. Market timing is difficult to predict and security selection is a zero sum game. That leaves asset allocation, where he concluded that “most of the return of a portfolio results from asset allocation”.

The Classic 60/40 Portfolio

I have previously questioned the validity of this popular asset allocation, as bonds and stocks are not always negatively correlated.

The above Artemis Capital note confirms my suspicions, stating that 90% of the price appreciation of such a portfolio came between 1984-2007. They show that the returns for bonds and equities over this time period were an outlier and the 60/40 portfolio is highly reliant on “assumptions derived from a once in a century bull market in Stocks and Bonds”. As they shrewdly observe:

“Recency Bias in now a Systematic Risk”

The note states that while these portfolios perform well in secular booms, they struggle when interest rates are at the zero bound (US 1930, Japan 90’s) or during periods of rapidly rising inflation (US 1970s). Like now.

In short, 60/40 portfolios may not provide the protection or return that their owners expect. Not that I’d expect them to pay any attention to these warnings, given their recent performance. Killer quote time:

“Most investors would rather fail conventionally than succeed unconventionally”

Correlation Analysis

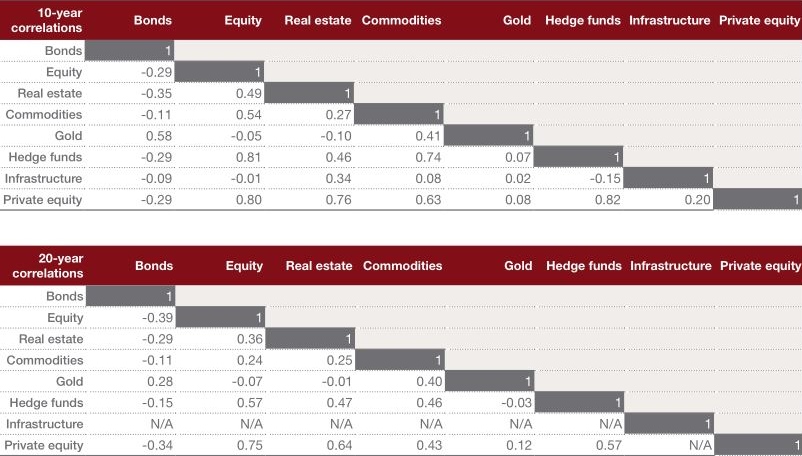

The following table, taken from a PWC report on sovereign wealth funds, shows the result of their analysis on correlations between various asset classes:

I’ve included the 10 year and 20 year tables, to roughly cover a market cycle and longer term.

To recap, the correlation figures range between 1 and -1, where +1 is a perfect correlation (when one item goes up, so does the other) and 0 represents no correlation (no relationship between the items). Negative values signify negative correlations, that is when one goes up the other goes down.

W.r.t. equities, the table indicates that gold is a useful diversifier, with no correlation. It also shows that bonds have been an excellent diversifier, being strongly negatively correlated. Commodities too look like they could be useful, though they appear to be more correlated in the recent past.